We moved!

Help articles have been migrated to the new Help and Support. You can find help for your products and accounts, discover FAQs, explore training, and contact us!

To set up an employee with a creditor garnishment and have the application make the appropriate calculations during payroll check entry, follow these steps.

See also: Garnishment overview

Setting up a vendor as a payroll agent for a creditor garnishment

The first step is to add or modify a payroll agent vendor to receive the garnishment deduction.

- To add a new vendor, choose Setup > Vendors and click the Add button. Or, for an existing vendor, click the Edit button.

- Enter vendor information as usual.

- In the Identification section of the Main tab, select Payroll Agent in the Vendor type field.

- In the Payment Preferences section, make your selections based on how you will submit the payment.

- If you're paying by check, select Check.

- If you're making the payment outside of Accounting CS, select Payment.

- If you're paying via direct deposit, select Direct Deposit and then, in the Direct Deposit tab, enter valid direct deposit information for the vendor.

- Click Enter to save your changes to the vendor.

Setting up creditor garnishment payroll items

You will need to create a payroll item for the client to use for employees with creditor garnishments.

- Add a new deduction item for the client.

Note: We recommend that you do not enter an agent in this section. You will select the appropriate agents when you add creditor garnishment order information for the employee.

- In the Special Type section of the Main tab of the Payroll Items screen, choose the Garnishment option and select Creditor garnishment from the drop-down list.

- Click Enter to save your changes

Adding the new deduction item to the employee record

- In the Setup > Employees > Payroll Items tab, make the new garnishment deduction item active for the employee by marking its checkbox in the Deductions grid.

- Click the

button for the new deduction item.

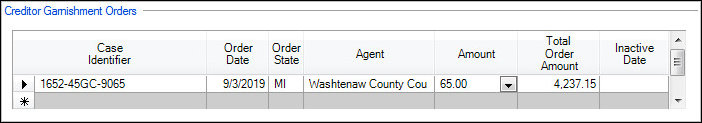

button for the new deduction item. - Enter or select the appropriate information in the Creditor Garnishment Orders section of the Main tab of the Employee Payroll Item Settings dialog.

- Case Identifier. (Required) Enter the case identification number.

- Order date. You can enter the date on which the order was issued. This field is not mandatory, but it is used to determine the priority of multiple garnishments when needed.

- Order State. Select the state in which the order was issued.

- Agent. You can use this field to assign a payroll agent to the creditor garnishment order to use for generating liabilities. The vendors listed in the Agent drop-down list are vendors that are set up with the Payroll Agent vendor type in the Setup > Vendors screen.

- Percent or Amount. Specify the percent or the amount that is to be deducted per paycheck.

- Total Order amount. You can use this field to specify a perpetual limit for the case. If you leave this field at its default $0.00 amount, the application will assume that the garnishment has no limit.

- Save the employee payroll item information.

Limits

Limits are restricted by the Consumer Credit Protection Act (CCPA).

Accounting CS withholds a creditor garnishment amount that is the lesser of:

- A percentage of disposable income (pay amount after all taxes including state and local) or

- The amount by which the weekly disposable income exceeds 30 x the federal minimum wage. (This calculation changes based on the pay frequency)

Notes

- These limits do not apply to garnishments for bankruptcy, child support, or federal or state tax levies.

- An employee will not be subject to the garnishment if their weekly disposable income amount is less than 30 x the federal minimum wage during that pay period.

Example of creditor garnishment limit calculations

Factors in this calculation:

| Garnishment percentage | 25% of disposable income |

| Employee’s gross pay amount | $550.00 |

| Taxes withheld | $105.38 |

| Employee’s net pay (disposable income) | $444.62 |

| Employee’s pay frequency | Bi-weekly (doubles the 30x to 60x) |

| Federal minimum wage | $7.25 |

The calculation for a garnishment will change based on the pay frequency for the employee. In this example, our employee is paid on a bi-weekly frequency, so our calculation is changed to the lesser of 25% of the employee’s disposable income or 60 times the federal minimum wage.

$550.00 – $105.28 = $444.62 (The employee’s disposable income for this pay period)

60 x $7.25 (minimum wage) = $435.00 (number of pay periods x federal minimum wage)

Accounting CS withholds the lesser of the following:

- 25 x $444.62 = $111.15 (25% of the employee’s disposable income for this pay period)

- $444.62 – $435.00 = $9.62 (disposable income minus the minimum wage calculation)

Because the second calculation is the lesser of the two amounts, Accounting CS withholds $9.62 for the payroll period.

- For specific information about how the Department of Labor calculates creditor garnishments and limits, see refer to their Fact Sheet #30.

- See US Department of Treasury Standard Form 329.

State-specific exceptions to garnishment limits

Most states use the limits described at the beginning of this section, but there are some exceptions.

Note: We recommend that you set up a separate creditor garnishment deduction item for employees that have creditor garnishment cases in any of the following states.

- Colorado.

If the creditor garnishment case is in the state of Colorado, the maximum amount of an employee's total disposable income that can be subject to garnishment in any work week may not exceed the lesser of:- 20% of the employee's disposable income for that week, or

- The amount by which the employee's disposable income for that week exceeds 40 times the federal minimum wage.

- Illinois.

If the creditor garnishment case is in the state of Illinois, the maximum amount of an employee’s total gross income that can be subject to garnishment in any work week may not exceed the lesser of:- 15% of the employee's gross income for that week, or

- The amount by which the employee's disposable income for that week exceeds 45 times the state minimum wage.

- Maine.

If the creditor garnishment case is in the state of Maine, the maximum amount of an employee's total disposable income that can be subject to garnishment in any work week may not exceed the lesser of:- 25% of the employee's disposable income for that week, or

- The amount by which the employee's disposable income for that week exceeds 40 times the federal minimum wage.

- Minnesota.

If the creditor garnishment case is in the state of Minnesota, the maximum amount of an employee’s total disposable income that can be subject to garnishment in any work week may not exceed the lesser of:- 25% of the employee's disposable income for that week, or

- The amount by which the employee's disposable income for that week exceeds 40 times the federal minimum wage.

- Nevada.

If the creditor garnishment case is in the state of Nevada, the maximum amount of an employee's total disposable income that can be subject to garnishment in any work week may not exceed the lesser of:- 25% of the employee's disposable income for that week, or

- The amount by which the employee's disposable income for that week exceeds 50 times the federal minimum wage.

- New Mexico.

If the creditor garnishment case is in the state of New Mexico, the maximum amount of an employee's total disposable income that can be subject to garnishment in any work week may not exceed the lesser of:- 25% of the employee's disposable income for that week, or

- The amount by which the employee's disposable income for that week exceeds 40 times the federal minimum wage.

- Virginia.

If the creditor garnishment case is in the state of Virginia, the maximum amount of an employee’s total disposable income that can be subject to garnishment in any work week may not exceed the lesser of:- 25% of the employee's disposable income for that week, or

- The amount by which the employee's disposable income for that week exceeds 40 times the federal minimum wage or the Virginia minimum wage, whichever is greater, at the time the earnings were paid.

- West Virginia. If the creditor garnishment case is in the state of West Virginia, the maximum amount of an employee's total disposable income that can be subject to garnishment in any work week may not exceed the lesser of:

- 20% of the employee's disposable income for that week, or

- The amount by which the employee's disposable income for that week exceeds 50 times the federal minimum wage.

Was this article helpful?

Thank you for the feedback!