We moved!

Help articles have been migrated to the new Help and Support. You can find help for your products and accounts, discover FAQs, explore training, and contact us!

To set up an employee with a Child Support Garnishment and have the application make the appropriate calculations during payroll check entry, follow these steps.

Setting up a vendor as a payroll agent

Check or Payment payment methods only

For clients with employees who pay child support deductions by check or outside of Accounting CS.

You will need to set up a payroll agent vendor for the deductions, if one is not already set up.

- Choose Setup > Vendors and click the Add button. If this is an existing vendor, click the Edit button.

- Enter the vendor information as usual.

- In the Identification section of the Main tab, the vendor type must be Payroll Agent.

- In the Payment Preferences section of the Main tab, choose the applicable payment method; Check if you'll be mailing a check, and Payment if you'll be paying the liability outside of Accounting CS.

- Click Enter to save your changes and then proceed to the Adding a child support payroll item for the client task.

Direct deposit payment method only

For clients with employees who make direct deposit child support payments.

You will need to set up a payroll agent vendor for the deductions, if one is not already set up.

- Choose Setup > Vendors and click the Add button. If this is an existing vendor, click the Edit button.

- Enter the vendor information as usual.

- In the Identification section of the Main tab, the vendor type must be Payroll Agent.

- In the Payment Preferences section of the Main tab, the payment method must be Direct Deposit.

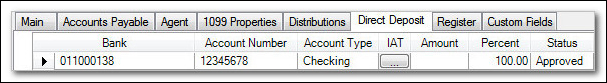

- In the Direct Deposit tab, enter valid direct deposit information for the vendor and then click Enter to save your changes.

Verifying the client's medical support status for the ACH addenda record

Direct deposit payment method only

For clients with employees who make direct deposit child support payments.

When child support payments are made via direct deposit, the ACH file includes the payment information along with the appropriate addenda record details. One of the required fields in that addenda record is the Medical Support Indicator field, which is used to specify whether or not the client offers a health care plan to the employee. To ensure that the addenda record is correct, follow these steps.

- Choose Setup > Clients and select the appropriate client.

- If the client offers a health care plan to its employees, click the Payroll Information tab and mark the Offers health care plan checkbox in the Miscellaneous Information section.

Note: If you mark the checkbox for a client, the application will place a Y in the Medical Support Indicator field of the addenda record when the child support payment is made via ACH. If you do not mark the checkbox, the application will place an N in that field.

- Click Enter to save the information.

Adding a child support payroll item for the client

Enter the child support payroll item in the same manner as you would any payroll item (see Creating and adding payroll items for your client). The following procedure highlights the steps specific to setting up child support payroll items.

- Choose Setup > Payroll Items and select the appropriate client record in the client selection field, if it's not already selected.

- In the Identification section, enter the description for the child support deduction item, choose Deduction as the payroll item type.

We recommend that you do not enter an agent in this section. You will select the appropriate agents when you add child support information for the employee.

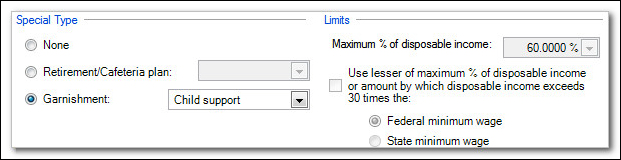

- In the Special Type section, choose the Garnishment option and select Child support from the drop-down list.

- Continue adding the payroll item as usual, and click the Enter button to save the child support payroll item.

Adding child support information for the employee

- Choose Setup > Employees, select the client (in the top, right-hand corner) and highlight the appropriate employee in the Employees list.

- In the Deductions grid of the Payroll Items tab, mark the Active checkbox next to the child support payroll item and click the Ellipsis

button to open the Employee Payroll Item Settings dialog for this item.

button to open the Employee Payroll Item Settings dialog for this item. - Certain sections are grayed out and can be modified only at the client payroll item level. Modify the fields in other sections for this employee as needed.

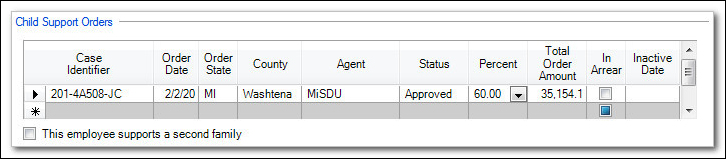

- In the Child Support Orders section, enter all of the child support orders for this employee in the grid. Orders for various amounts and states can be entered here using this single deduction item.

Note:

- In the Agent column, select the payroll agent vendor that was set up for the child support deduction. Only vendors set up as Payroll Agent type will show up in the drop-down list.

- The Maximum % of disposable income will default to the following rates based upon how the child support case is set up, but this field can be overridden to a value between 0% and 100% if a rate other than the default is needed.

- If no additional checkboxes are marked, the maximum % of disposable income will be set to 60%.

- If the In Arrears checkbox is marked, the maximum % of disposable income will be set to 65%.

- If the This employee supports a second family checkbox is marked, the maximum % of disposable income will be set to 50%.

- If both the In Arrears and This employee supports a second family checkboxes are marked, the maximum % of disposable income will be set to 55%

- The case information that you enter into the grid (Case identifier, date, state, agent, etc.) will appear in the addenda record for the ACH file that is created when the vendor check with the liability is printed. This identifies the court case to which the direct deposit amount should be applied.

- When you enter the state and county for the child support order, the application automatically generates the appropriate FIPS code within the addenda record for the ACH file .

- The Total Order Amount field also specifies a perpetual limit for the case. If you leave this field at its default $0.00 amount, the application assumes that the garnishment deduction(s) has no limit.

- When there are multiple orders, enter them in the grid, specifying the amount for each in the Amount column. If there is not enough disposable income to cover the amounts, Accounting CS will prorate the garnishment amounts using the ratio of each order amount compared to the total disposable income amount.

- Click OK to save the payroll item settings.

Was this article helpful?

Thank you for the feedback!