We moved!

Help articles have been migrated to the new Help and Support. You can find help for your products and accounts, discover FAQs, explore training, and contact us!

Introduction

Overtime payments are generally calculated at one and a half (1.5) times the employee's regular rate of pay for all hours worked beyond 40 hours in a week. For a variety of reasons, a client may want to calculate overtime payments using the weighted average method instead. Some scenarios include:

- The client has a non-exempt employee who holds more than one position/job description with the company, each with a different hourly rate of pay, and has overtime hours.

- The client has a non-exempt employee who has overtime hours and is partially compensated by a non-hours-based payment, such as commission.

- The client has a salaried, non-exempt employee and pays the employee a fixed salary for a fluctuating work week. The employee must still be compensated for overtime hours on a half-time basis.

Note: Weighted Average Overtime calculations are designed for overtime calculations only and do not apply to double-time calculations.

Setting up WAOT pay items for a client

To use the weighted average overtime calculation for an employee, you need to set up one of the client's pay items as special type Weighted Average Overtime.

Follow the instructions for creating and adding payroll items for your client as usual. In the Special Type section, select Weighted Average Overtime.

You may also need to set up a pay item as special type Premium Wages, such as in the case of an employee who receives a shift premium. For an example of this, see the section covering employees who receive a shift premium.

Setting up an employee to use a WAOT pay item

To calculate an employee's overtime using the weighted average method, you must set up the employee to use a pay item assigned as special type Weighted Average Overtime.

Follow the instructions for adding payroll items to an employee record as usual. The pay item that you mark as active for the employee must be set up as special type Weighted Average Overtime.

Excluding pay items from WAOT calculations

If an employee has an active pay item set up as special type Weighted Average Overtime, all other pay items active for the employee will also be subject to WAOT calculation. However, you can exclude pay items individually from the WAOT calculation.

- Choose Setup > Payroll Items and click the Main tab.

- Select the payroll item that you want to exclude and click the Edit button.

- In the Exclusions section, mark the Weighted average overtime calculation checkbox.

- Click the Enter button to save the change.

Setting up a shift-premium employee to use the WAOT calculation

In some situations, an employer may want to include the dollar amount associated with a pay item in the weighted average overtime calculation, but not want to include the hours associated with the pay item. An example of this would be if an employee is paid a shift premium. You can set up the employee as follows.

- Follow the instructions for creating and adding payroll items for your client as usual to add a new shift premium pay item. In the Special Type section, select Premium Wages.

- Follow the instructions for adding payroll items to an employee record as usual, and in the Payroll Items tab of the Employees screen, mark as active both the pay item set up as special type Weighted Average Overtime and the pay item set up as special type Premium Wages.

- In the Rate column, enter the pay rates for the active pay items. The first pay item should use the employee's regular rate and the other pay item (the one that is special type Premium Wages) should use the employee's premium amount.

- During payroll check entry for the employee, you should enter hours for the pay item using the regular rate and for the pay item using the premium rate, to compensate the employee for their shift premium.

The check will show double the number of hours worked on the check, but because the hours associated with the premium rate pay items are excluded from WAOT calculation, the amount will be correct.

Entering payroll checks for clients using WAOT

Enter payroll checks for the client as usual.

When payroll checks are entered for an employee that is subject to the WAOT calculation, the application uses the following formula to calculate the employee's overtime.

- The total gross pay of all pay items / the total hours entered (excluding Premium Wages pay items and any other excluded pay items)= Average Regular Rate.

- The Average Regular Rate x 0.5 (WAOT rate) = Premium Overtime Rate.

- The Premium Overtime Rate x total Overtime hours entered = WAOT amount.

Example WAOT calculation

Example WAOT calculation

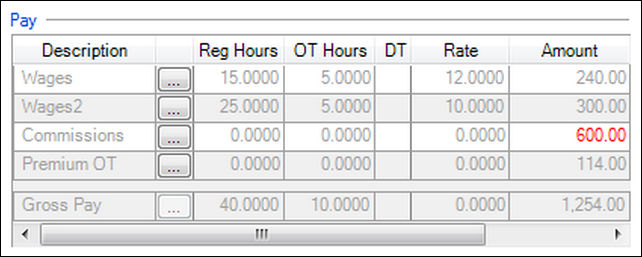

Assume the employee is set up with the following pay items.

- Wages 1 (Hourly pay item) - $12.00 rate

- Wages 2 (Hourly pay item) - $10.00 rate

- Commission (Fixed amount pay item)

- Premium OT (Weighted average overtime pay item)

Here is how the WAOT calculation works for this scenario.

Hours/amounts entered on the check:

| Wages 1: 20 hours (15 reg + 5 OT) @ $12.00 | $240.00 |

| + Wages 2: 30 hours (25 reg + 5 OT) @ $10.00 | $300.00 |

| + Commission | $600.00 |

| =Total gross pay | $1140.00 |

Weighted average overtime calculation (Premium OT):

| $1140.00 (Total gross pay) / 50 (total hours) = $22.80 (Regular rate) |

| $22.80 (Regular rate)x 0.5 (WAOT rate) = $11.40 (Premium rate) |

| $11.40 (Premium rate) x 10 (number of OT hours) = $114.00 (WAOT amount) |

Was this article helpful?

Thank you for the feedback!