To set up an employee with a Defaulted student loan garnishment and have the application make the appropriate calculations during payroll check entry, follow these steps.

See also: Garnishment overview

Adding a defaulted student loan garnishment to an employee record

- In the Setup > Employees > Payroll Items tab, make the new garnishment deduction item active for the employee by marking its checkbox in the Deductions grid. If a defaulted student loan garnishment deduction item is not listed, contact your Payroll Specialist.

- Click the Ellipsis

button for the new deduction item.

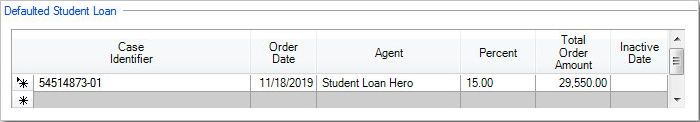

button for the new deduction item. - Enter or select the appropriate information in the Defaulted Student Loan section of the Main tab of the Employee Payroll Item Settings dialog. Show me.

- Case Identifier. (Required) Enter the case identification number.

- Order date. You can enter the date on which the defaulted student loan order was issued. This field is not mandatory, but it is used only to determine the priority of multiple garnishments when needed.

- Agent. You can use this field to assign a payroll agent to the defaulted student loan order to use for generating liabilities. If necessary, you can set up a new agent in the Setup > Vendors screen.

- Percent or Amount. Specify the percent or the amount that is to be deducted per paycheck.

- Total Order amount. You can use this field to specify a perpetual limit for the case. If you leave this field at its default $0.00 amount, the application will assume that the garnishment has no limit.

- Inactive date. Use this field to specify a date on which the garnishment is no longer active. Payroll checks entered on or after this date will not include this garnishment. Note that the date you enter here must fall on or after the date in the Order date field.Save the employee payroll item information.

Limits

Limits are restricted by the Consumer Credit Protection Act (CCPA).

Defaulted student loans are calculated as the lesser of:

- 25% of disposable income (after all taxes including state and local).

- The amount by which disposable income exceeds 30 x the federal minimum wage.

Note: The amount deducted for each defaulted student loan order is typically limited to 15% of disposable income; however, an employee can provide written consent to withhold more. The total limit, for an individual defaulted student loan case or multiple cases, is 25% of disposable income.

For specific information and examples of how the Department of Labor calculates garnishments and limits, refer to their Fact Sheet #30.

Was this article helpful?

Thank you for the feedback!

myPay Solutions

myPay Solutions