We moved!

Help articles have been migrated to the new Help and Support. You can find help for your products and accounts, discover FAQs, explore training, and contact us!

Use the Local dialog to add or modify certain information to be used for local tax agents. For each individual tax, you can specify a different withholding ID and deposit schedule to use and also specify whether or not the client has in this locality.

If a client has nexus in a jurisdiction, it means that they have a business connection or a presence in that jurisdiction and are therefore subject to state or local income and sales taxes.

Choose Setup > Clients, click the Payroll Taxes tab, and click the Local button in the State section.

Notes

- For New York clients - you can use this dialog to modify the tax rate for the Metropolitan Commuter Transportation Mobility Tax (MCTMT).

- For San Francisco, California clients - you can use this dialog to prevent the application from calculating San Francisco Payroll Expense Tax on checks.

Fields & buttons

Local grid. The grid contains a list of the local taxes that apply to the selected client. If you want to specify a withholding ID to be used with a tax, enter it in the Withholding ID column. In addition, you can modify the deposit schedule for the agent that corresponds to each tax. If the client has in this locality, you can specify that here by marking the checkbox in the Nexus column.

If a client has nexus in a jurisdiction, it means that they have a business connection or a presence in that jurisdiction and are therefore subject to state or local income and sales taxes.

Note: Only localities that are assigned to a tax agent display in the Local grid.

Default EIT Tax Collector. (Pennsylvania only) The agent that you select here will be the default agent used for any combined earned-income tax items added in the future for this client.

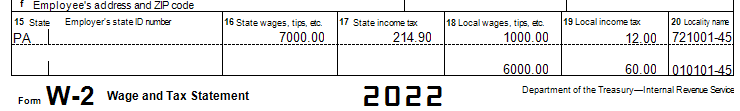

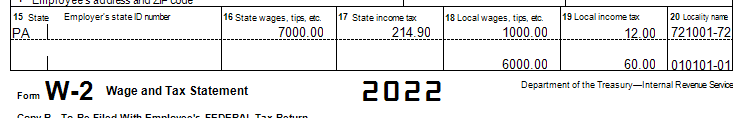

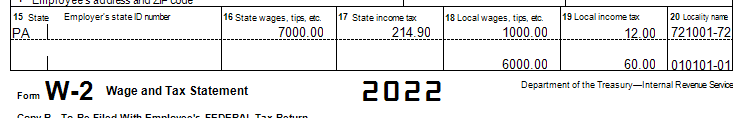

W2 PSD Code. (Pennsylvania only) For each work location that an employee has wages or tax amounts associated with it, the PSD code (known as the TCD code) for that work location is reported in Box 20 on all copies of the employee's W-2 forms. The application does the following to determine the PSD code that is used in Box 20.

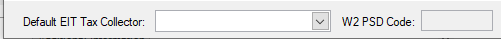

- If no selection is made in the Default EIT Tax Collector field:

- The W2 PSD Code field is disabled and ignored.

- The six-digit PSD code of the work location that is assigned to the tax item by the state of Pennsylvania, followed by a dash (-) and the first two digits of that PSD code is used as the PSD code in Box 20.

Note: For employees who work in multiple work locations, each location's unique six-digit PSD code that is assigned to the tax item by the state of Pennsylvania, followed by a dash (-) and the first two digits of that PSD code is used as the PSD code in Box 20 on the line with the associated wage and tax amounts.

Local dialog:

Form W-2 output:

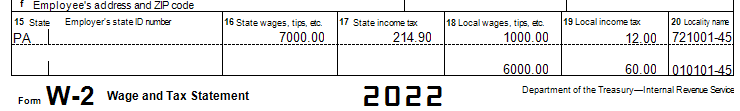

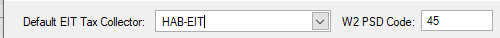

- If a selection is made in the Default EIT Tax Collector field:

- The W2 PSD Code field is enabled and allows a 2-digit code to be entered.

- The six-digit PSD code of the work location that is assigned to the tax item by the state of Pennsylvania, followed by a dash (-) and the two digits entered in the W2 PSD Code field is used as the PSD code in Box 20.

Note: For employees who work in multiple work locations, each location's unique six-digit PSD code that is assigned to the tax item by the state of Pennsylvania, followed by a dash (-) and the two digits entered in the W2 PSD Code field is used as the PSD code in Box 20 on the line with the associated wage and tax amounts.

Local dialog:

Form W-2 output: