We moved!

Help articles have been migrated to the new Help and Support. You can find help for your products and accounts, discover FAQs, explore training, and contact us!

This article explains the application changes that we’ve made, and changes we’re currently working on, to address the requirements of the Coronavirus-related acts that impact payroll processing.

We will update this article frequently to add more accurate release date projections and additional included features.

Coronavirus related acts

Families First Coronavirus Response (FFCR) Act

The U.S. Treasury, IRS, and U.S. Dept of Labor has communicated guidance on the Family First Coronavirus Response (FFCR) Act, which provides Coronavirus-related paid leave for workers and tax credits for small and midsize businesses to recover Coronavirus-related leave costs.

This bill responds to the Coronavirus outbreak by providing paid sick leave and free Coronavirus testing, expanding food assistance and unemployment benefits, and requiring employers to provide additional protections for health care workers.

For more specific information about this Act, refer to the March 20, 2020 IRS IR-2020-57 News Release.

Coronavirus Aid, Relief, and Economic Security (CARES) Act

The U.S. Treasury, IRS, and U.S. Dept of Labor has communicated guidance on the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which is intended to help businesses keep employees on their payroll by allowing for deferred payments on some employer taxes, providing an employee retention credit, and enabling small businesses to apply for loans, and more.

For more specific information about this Act, see The CARES Act Works For All Americans page on the U.S. Treasury website.

President Trump's Memorandum

On August 8, 2020 President Trump signed a Presidential Memorandum intended to provide assistance in payroll tax deferment, evictions, foreclosures, and more. For more specific information about the payroll tax deferment, refer to the IRS notice 2020-65.

Consolidated Appropriations Act of 2021

On December 21, 2020, the U.S. Congress passed the Consolidated Appropriations Act of 2021, which President Trump signed into law on December 27, 2020. The act extends current COVID-19 related provisions, including the COVID-19 sick paid leave, Employee Retention Credit, and Paycheck Protection Program that were due to expire on December 31, 2020.

American Rescue Plan Act of 2021

On March 10, 2021, the U.S. Congress passed the American Rescue Plan Act of 2021, which President Biden signed into law on March 11, 2021. The act extends current COVID-19 related provisions, including the COVID-19 sick paid leave and family paid leave credits, Employee Retention Credit, and Paycheck Protection Program.

Infrastructure Investment and Jobs Act of 2021

On November 5, 2021, the U.S. House of Representatives passed the Infrastructure Investment and Jobs Act of 2021, which President Biden signed into law on November 15, 2021. As part of the act, the Employee Retention Credit which was previously set to expire on January 1, 2022 was retroactively terminated as of October 1, 2021. The newly-enacted termination date excludes eligible employers that are a recovery start-up business.

For IRS guidance on how to handle previously claimed employee retention credits taken in the fourth quarter, see Notice 2021-65.

Application updates

v.2022.1.0 - Released on March 24, 2022

- We updated Forms 943-X and 944-X to the latest versions released by the IRS.

v.2021.4.0 - Released on December 20, 2021

- We updated Form 943 and Form 944, which include the various COVID-19 and ARPA credits, for the 2021 tax processing period. See the Form 943: COVID-19 changes and Form 944: COVID-19 changes articles for details about the changes and additions to these forms.

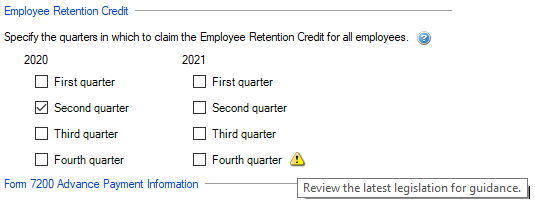

- We added an information diagnostic message to Forms 941, 943, and 944 if the 2021 Fourth quarter checkbox in the Employee Retention Credit section in the COVID-19 Acts tab of the Setup > Clients screen is marked. We recommend data entry be reviewed for these clients based on the latest IRS guidance issued in Notice 2021-65.

For more information, see COVID-19 - Employee Retention Credit. - Pay items with a Special Type of ARPA self care, ARPA other care, or ARPA extended care were updated to have the Box 14 - Other field marked in the W-2 Additional Boxes section on the Setup > Payroll Items screen.

- By default, the W-2 Box 14 description on the pay item will display one of the following descriptions:

- ARPA 511 for pay items with the ARPA self care special type,

- ARPA 200 for pay items with the ARPA other care special type, or

- ARPA ESL for pay items with the ARPA extended care special type.

- By default, the W-2 Box 14 description on the pay item will display one of the following descriptions:

v.2021.3.0 - Released on September 27, 2021

- We have added a warning message to the Fourth quarter checkbox in the Employee Retention Credit section in the COVID-19 Acts tab of the Setup > Clients screen. Show me. For more information, see COVID-19 – Employee Retention Credit.

We are closely monitoring tax law changes as they are announced, and we will continue to alert you to upcoming changes as we work to meet the requirements of any pending legislation, including the $1.2 trillion infrastructure plan. On August 10, 2021, the U.S. Senate passed the Infrastructure Investment and Jobs Act. As part of the bill, the termination date for the Employee Retention Credit was accelerated to September 30, 2021. However, as of the date of this release (v.2021.3.0), the U.S. House of Representatives has not taken up the Senate-approved legislation for final passage.

- We have updated Form 941-X to the latest version released by the IRS.

v.2021.2.1 - Released on July 12, 2021

- We added the following variables to the Client > COVID-19 Acts Information section of the variable tree in the Report Designer:

- Second Quarter 2021 COBRA Number of Individuals

- Second Quarter 2021 COBRA Premium Credit

- Third Quarter 2021 COBRA Number of Individuals

- Third Quarter 2021 COBRA Premium Credit

v.2021.2.0 - Released on June 24, 2021

- We updated Form 941 and the electronic file to the latest version released by the IRS for tax processing periods 6/30/2021, 9/30/2021, and 12/31/2021.

- We updated the user interface of the COVID-19 Acts tab on the Setup > Clients screen to accommodate the Form 94x changes included in the American Rescue Plan Act (ARPA) of 2021.

- We added the ability to manually create a "FIT ARPA Tax Adj" liability for the 941 and 943 vendors in the Actions > Manage Payroll Liabilities screen.

- We updated the EFTPS files created in the Actions > Process EFTPS screen to use the following codes for FICA-SS deferred tax payments.

- 94107 for Form 941 FICA-SS deferred payments

- 09437 for Form 943 FICA-SS deferred payments

- 09447 for Form 944 FICA-SS deferred payments

- We updated the 7200 Worksheet - COVID-19 report that is available in the Accounting CS Library to include the various ARPA credits that were part of the American Rescue Plan Act of 2021. For more information, see COVID-19 Custom reports.

- We updated Form 944-X to the latest version released by the IRS.

v.2021.1.1 - Released on April 22, 2021

- We released the following changes in response to the American Rescue Plan Act (ARPA) of 2021.

- We added the following new special type options as available selections in the Setup > Payroll Items screen for creating new paid sick leave and family leave pay items. Details

- ARPA self care

- ARPA other care

- ARPA extended care

For more information, see the following articles.

Any payroll checks entered in the application prior to installing the 2021.1.1 release that need to reflect ARPA-related paid leave wages will need to be reversed/voided/deleted and re-entered using the appropriate special type pay items.

- We updated the calculation of COVID-19 paid sick leave and paid family leave in 2021 to payroll checks where the period begin or period end dates are on or before March 31, 2021.

- We added Third quarter and Fourth quarter checkboxes for 2021 to the Employee Retention Credit section of the COVID-19 Acts tab in the Setup > Clients screen as a result of the credit being extended to the end of 2021.

- We added the Exclude from Employee Retention Credit checkbox to the COVID-19 settings section of the Payroll Taxes tab in the Setup > Employees screen. Details

- We updated the following reports in the Accounting CS Library to include the various COVID-19 credits that have been extended into 2021. For more information, see COVID-19 - Custom reports.

- Cash Requirements and Deposits - COVID-19

- Depository Totals - COVID-19

- EFTPS Payment Worksheet - COVID-19

- EFTPS Phone Payment Worksheet - COVID-19

- Employee Retention Credit Summary

- Preprocessing Summary - COVID-19

- We added the following variables to the Client > COVID-19 Acts Information section of the variable tree in the Report Designer.

- Claim Third Quarter 2021 Employee Retention Credit

- Claim Fourth Quarter 2021 Employee Retention Credit

- We added the following variable to the Employee > COVID-19 Settings section of the variable tree in the Report Designer.

- Exclude from Employee Retention Credit

- We added the following new special type options as available selections in the Setup > Payroll Items screen for creating new paid sick leave and family leave pay items. Details

- We updated Form 943-X to the latest version released by the IRS for tax processing period 2020 and later.

- We updated the Payroll Tax Form analysis tool (accessed via Actions > Analyze Client Activity > Payroll Tax Form when Form 941 is selected for processing in the Actions > Edit Payroll Tax Forms screen) to display the correct FICA-SS ER (Calculated) amounts. Details

v.2021.1.0 - Released on March 25, 2021

- We released the following changes in response to the American Rescue Plan Act of 2021.

- We extended the calculation of COVID-19 paid sick leave and paid family leave in 2021 to payroll checks where the period begin or period end dates are on or before September 30, 2021.

- We updated the user interface on the COVID-19 Acts tab of the Setup > Clients screen in the following two sections to assist you with entering 2021 values for Form 941 information.

- Form 7200 Advance Payment Information. Use this section to record any advance payments requested that should be reported on Form 941, 943, or 944 for 2020 or 2021.

- Federal 94x Information. Use this section to record any qualified health plan expenses that should be allocated to the COVID-19 related sick leave or family leave wages reported on Form 941, 943, or 944 for 2020 or 2021.

- We updated Form 941 and the electronic file to the latest version released by the IRS for tax processing periods 3/31/2021 and later. For more information, see Form 941: COVID-19 changes.

- We updated the 7200 Worksheet - COVID-19 report in the Accounting CS Library to include the various COVID-19 credits that have been extended into 2021. For more information, see COVID-19 reports.

- We added the 7200 Advance Year variable to the Client > COVID-19 Acts Information section of the variable tree in the Report Designer.

- We re-enabled the Payroll Tax Form option (accessible via the Actions > Analyze Client Activity menu) when 2020 or 2021 is selected as the Form 941 processing year in the Actions > Edit Payroll Tax Forms screen. Details

v.2020.4.2 - Released on January 21, 2021

- We updated Form 941-X to the latest version released by the IRS for tax processing periods 9/30/2020 and later.

- We added the following for the Employee Retention Credit:

- On the COVID-19 Acts tab on Setup > Clients, we added First quarter and Second quarter checkboxes for 2021.

- When the 2021 checkboxes are marked, the Employee Retention Credit is calculated at 70% (instead of 50%) for each employee up to $10,000 in qualified wages per quarter (instead of per calendar year).

v.2020.4.1 - Released on January 7, 2021

- We released the following in response to the Consolidated Appropriations Act of 2021.

- The Average Payroll Cost Worksheet in the Accounting CS Library has an option to use a 3.5 multiplier instead of a 2.5 multiplier.

- Deduction items with the Deferred FICA-SS repayment special type have a default end date of 12/31/2021.

- Open FICA-SS liabilities generated from payroll checks in 2020 have an updated due date of 12/31/2021 if it is flagged by the application as Deferred per Memorandum in the Actions > Manage Payroll Liabilities screen.

- The application now extends the calculation of COVID-19 paid sick leave in 2021 to payroll checks where the period begin and period end dates are on or before March 31, 2021.

v.2020.4.0 - Released on December 21, 2020

- We provided Form 943 and Form 944 for the 2020 tax processing period. See the Form 943: COVID-19 changes and Form 944: COVID-19 changes articles for details about the changes and additions made to these forms.

- Pay items with a Special Type of COVID-19 self care, COVID-19 other care, or COVID-19 extended child care were updated to have the Box 14 - Other field marked in the W-2 Additional Boxes section on the Setup > Payroll Items screen.

- By default, the W-2 Box 14 description on the pay item will display one of the following descriptions:

- EPSLA 511 for pay items with the COVID-19 self care special type,

- EPSLA 200 for pay items with the COVID-19 other care special type, or

- EFMLEA for pay items with the COVID-19 extended child care special type.

- By default, the W-2 Box 14 description on the pay item will display one of the following descriptions:

- 2020 W-2 Box 4 shows the net amount of the employee portion of FICA-SS and the deferred amount for the year.

- We added a new deduction item Special Type called Deferred FICA-SS repayment. For details, see the COVID-19: Deferral of employee FICA-SS article for details.

v.2020.3.1 - Released on October 22, 2020

- We updated Form 941-X to the latest version released by the IRS for tax processing periods 6/30/2020 and prior.

v. 2020.3.0 - Released on September 30, 2020

- We updated Form 941 and the electronic file to the latest version released by the IRS for tax processing periods 9/30/2020 and 12/31/2020. See the Form 941 2020: Covid-19 changes article for details about the changes and additions that were made to the form.

v.2020.2.6 - Released on September 10, 2020

- COVID-19 Employee FICA-SS deferral. With this release, you can specify that you want to defer the FICA-SS amount for certain employees. Accounting CS will create an offsetting Deferred FICA-SS tax item and create liabilities with a due date of April 30, 2021. For more information see COVID-19: Deferral of employee Social Security tax withholding.

- We updated the COVID-19 custom reports in the Accounting CS Library to include Employee FICA-SS deferral information.

- We added several variables to the variable tree in the Report Designer. Details

v.2020.2.0 - Released on June 26, 2020

- We updated Form 941 and the electronic file to the latest version released by the IRS for tax processing periods 6/30/2020, 9/30/2020, and 12/31/2020. See the Form 941 2020: Covid-19 changes article for details about the changes and additions that were made to the form.

- We added two sections to the COVID-19 Acts tab of the Setup > Clients screen to help you enter 2020 Form 941 information for quarters 2, 3, and 4.

- Form 7200 Advance Payment Information. Use this section to record any advance payments requested that should be reported on Form 941, 943, or 944.

- Federal 94x Information. Use this section to record any qualified health plan expenses that should be allocated to the Families First Coronavirus Response Act (FFCRA) related wages and reported on Form 941.

- We added the 7200 Worksheet – COVID-19 to the Accounting CS Library. For more details see COVID-19 - Custom reports (when v.2020.2.0 is released).

- We added variables to the Client > COVID-19 Acts Information section of the variable tree. Details

- We disabled the Payroll Tax Form option (accessible via the Actions > Analyze Client Activity menu) when 2020 is selected as the Form 941 processing year in the Actions > Edit Payroll Tax Forms screen. Details

Released on June 8, 2020 (no related application update)

We have added the PPP Loan Forgiveness Payroll Worksheet to the Accounting CS Library. You can provide this report to your clients to help them fill out the Small Business Association (SBA) loan forgiveness application. For more details about the Paycheck Protection Program, as specified in the CARES Act, see the PPP Borrower Information Fact Sheet (from home.treasury.gov).

v.2020.1.4 - Released on May 26, 2020

- Employee Retention Credit. (CARES Act) In this release, we addressed the Employee Retention Credit, which is designed to encourage employers to keep employees on the payroll, despite the economic hardship brought about by COVID-19. This credit can be used only for wages not already credited by the FFCR COVID-19 paid sick leave credit.

- We added methods to automatically and manually create a “FIT Employee Retention Tax Adj " liability in the amount of the Employee Retention Credit. Employers that had 101 or more employees in 2019 will need to use the manual method. For more information, see COVID-19 - Employee Retention Credit.

- We added Employee Retention Credit-related variables to the Client > COVID-19 Acts Information section of the variable tree in the Report Designer. Details

- We added the Employee Retention Credit Summary to the Accounting CS Library.

- We updated the COVID-19 custom reports in the Accounting CS Library to include Employee Retention Credit information.

v.2020.1.3 - Released on May 4, 2020

- Automatic tax liability adjustment for the Employer portion of FICA-MED. (FFCR Act) This liability adjustment is automated for payroll checks processed after this update. For payroll checks processed prior to installing this update, you will need to use the manual process, documented in the COVID-19 liability credit information article.

- Ability to manually create COVID-19 deferred FICA-SS liabilities. We have added the ability to manually create employer FICA-SS tax liabilities in the Actions > Manage Payroll Liabilities screen, so clients can split and defer payment of the liabilities, as specified by the CARES Act.

v.2020.1.2 - Released on April 27, 2020

- COVID-19 paid sick leave tracking. (FFCR Act) With this release, Accounting CS will alert you during payroll check entry if an employee uses more than the allowable number of hours for a COVID-19 sick leave type. For more information, see Setting up and using COVID-19 sick leave.

- COVID-19 Employer FICA-SS deferral. (CARES Act) With this release, you can specify that you want to defer the ERFICA-SS amount. Accounting CS will split the amount into two, and specify new due dates for the end of years 2021 (for 50% of the amount) and 2022 (for the remaining 50%). For more information see COVID-19 - Deferral of employer Social Security tax payments.

- New reports that include COVID-19 information. We will add the following reports to the Accounting CS Library.

- Cash Requirements and Deposits - COVID-19

- Depository Totals - COVID-19

- EFTPS Payment Worksheet - COVID-19

- EFTPS Phone Payment Worksheet - COVID-19

- Preprocessing Summary - COVID-19

For more information about these reports, see COVID-19 - Custom reports.

v.2020.1.1 - Released on April 6, 2020

- COVID-19 paid sick leave. (FFCR Act) We added a number of Special type options for creating new paid leave payroll items. See the following articles.

- COVID-19 liability credits. (FFCR Act) Accounting CS automatically creates liability credits for COVID-19 paid sick leave payroll items. To learn how to create liability payments for the Employer portion of FICA-MED paid on COVID-19 leave wages (a workaround until the application does this automatically) and the employer share of employee healthcare costs, see the COVID-19 liability credit information article.

- Paycheck Protection Program. (CARES Act) We have added the Average Payroll Cost Worksheet to the Accounting CS Library. You can provide this report to your clients to help them apply for the Paycheck Protection Program.

Additional resources and news

- Thomson Reuters Labs have designed some interactive tools that you can share with your clients to help them navigate the economic challenges brought about by COVID-19 and highlight your firm as a trusted source of information during this crisis. Consider adding these tools to your website to enable your clients to easily answer the questions, print the resulting recommendations, and then schedule an appointment with your firm.

- The Interactive SBA Loan Analysis Tool was designed to help you and your clients determine which loans their businesses qualify for under the CARES Act. By answering a few short questions, you can instantly receive small business loan recommendations. Watch an introductory video.

- The Interactive Employee Retention Credit Eligibility Tool was designed to help you and your clients determine if their businesses qualify for the Employee Retention Credit. Answer a few short questions to instantly receive recommendations.

- The COVID-19 Paid Leave Tax Credit Tool was designed to help you and your clients determine if their businesses qualify for a tax credit for providing COVID-19 emergency paid sick leave and/or expanded family leave. After answering a few short questions, the tool instantly determines eligibility and explains how to claim the credits.

- If your firm’s operations have been heavily impacted or you need assistance during these challenging times to meet your client’s payroll needs, the Thomson Reuters myPay Solutions team is prepared and ready to help your firm overcome any business continuity challenges. Our entire myPay Solutions team is up and running. We are here right now to support you, and will continue to do so even as the surrounding business conditions change. Contact us by calling 844.332.5157.

- Because a growing number of cities and states have restricted consumers from leaving their homes for non-essential purposes, many financial institutions are closing their branches or reducing their branch hours. So, for those of you who want to learn more about offering Direct Deposit services to clients, we have posted a webinar on how to get started with Kotapay. Kotapay is a trusted partner of Thomson Reuters and is fully integrated into Accounting CS Payroll. In addition, Kotapay offers a new prefunding solution for payroll that allows for cleared funds to be sent within a 4 day time period. For more information, read their article, Managing Risk during this Uncertain Time.

- Thomson Reuters is committed to assisting all payroll providers with compliance requirements resulting from the rapidly evolving legislation. To prepare your staff, we are offering a FREE Checkpoint Learning course that discusses family and medical leave, sick leave, tax credits to employers and self-employed taxpayers providing the leave, and the effect on employer-sponsored health plans. This free course, The Families First Coronavirus Response Act of 2020 - Overview, provides a general review of new developments in taxation.

- Thomson Reuters has also aligned with the AICPA, and a coalition of payroll providers, to advocate the use of payroll processors to quickly distribute governmental funds to small businesses. You can read the Open Letter to President Donald J. Trump from the AICPA-led coalition.

Was this article helpful?

Thank you for the feedback!